The app offers access to global financial markets and business news, market price data, and portfolio tracking tools. TD Ameritrade Partner Links. Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. Even still, the introductory and supporting materials are worth getting to grips with, and if you want to get involved with more than currency trading you’re in an ideal place to expand your investment strategy into other products.

Why Trade Currencies?

The investment markets can quickly take the money of investors who believe that trading is easy. Trading in any investment market is exceedingly difficult, but success first comes with education foreign currency trading app practice. So, what is currency trading and is it right for you? The currency market, or forex FXis the largest investment market in the world and continues to grow annually. The market may be large, but until recently the volume came from professional traders, but as currency trading platforms have improved more retail traders have tading forex to be suitable for their investment goals.

Top Traders

The term «currency trading» can mean different things. If you want to learn about how to save time and money on foreign payments and currency transfers, visit XE Money Transfer. These articles, on the other hand, discuss currency trading as buying and selling currency on the foreign exchange or «Forex» market with the intent to make money, often called «speculative forex trading». XE does not offer speculative forex trading, nor do we recommend any firms that offer this service. These articles are provided for general information only. The currency exchange rate is the rate at which one currency can be exchanged for another.

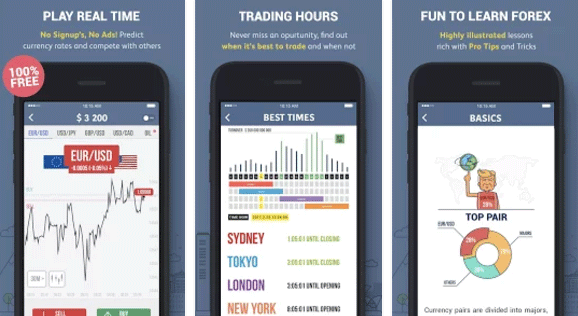

Best apps for forex trading — at a glance

The investment markets can quickly take the money of investors who believe that trading is easy. Trading in any investment market is exceedingly difficult, but success first comes with education and practice. So, what is currency trading and is it right for you? The currency market, or forex FXis the largest investment market in the world and continues to grow annually.

The market may be large, but until recently the volume came from professional traders, but as currency trading platforms have improved more retail traders have found forex to be suitable for their investment goals. Currency trading is a hour market that is only closed from Friday evening to Sunday evening, but the hour trading sessions are misleading. There are three sessions that include the European, Asian and United States trading sessions.

Although there is some overlap in the sessions, the main currencies in each market are traded mostly during those market hours. This means that certain currency pairs will have more volume during certain sessions. Traders who stay with pairs based on the dollar will find the most volume in the U. Currency is traded in various sized lots. The micro-lot is 1, units of a currency.

If your account is funded in U. A mini lot is 10, units of your base currency and a standard lot isunits. All currency trading is done in pairs. Unlike the stock marketwhere you can buy or sell a single stock, you have to buy one currency and sell another currency in the forex market.

Next, nearly all currencies are priced out to the fourth decimal point. A pip or percentage in point is the smallest increment of trade. Retail or beginning traders often trade currency in micro lots, because one pip in a micro lot represents only a cent move in the tradimg.

This makes losses easier to manage if a trade doesn’t produce the intended results. Some currencies move as much as pips or more in a single trading session making the potential losses to the small investor much more manageable by trading in micro or mini lots.

The majority of the volume in currency trading is confined to only 18 currency pairs compared to the thousands of stocks that are available in the global equity markets.

Although there are other traded pairs outside of the 18, the eight currencies most often traded are the U. Although nobody would say that currency trading is easy, having far fewer trading options makes trade and portfolio management an easier task. An increasing amount currrency stock traders are taking interest in the currency markets foreign currency trading app many of the forces that move currenc stock market also move the currency market.

One of the largest is supply and demand. When the world needs more dollars, the value of the dollar increases and when there are too many circulating, the price drops. Other factors like interest ratesnew economic foteign from the largest countries and geopolitical tensions, are just a few of the events that may affect currency prices.

Much like anything in the investing market, learning about currency trading is easy but finding the winning trading strategies takes a lot of practice. Your Money. Personal Finance. Your Practice. Popular Courses.

Login Newsletters. Part Of. Basic Forex Overview. Key Forex Concepts. Currency Markets. Advanced Forex Traxing Strategies and Concepts. Table of Contents Expand. How Does it Work? Pairs and Pips. Far Fewer Products. What Moves Currencies?

The Bottom Line. Key Takeaways Forex exchanges allow for trading in currency pairs, making it fodeign world’s largest and most liquid asset market. Currencies are traded against one another as pairs e. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Partner Links. Standard Lot Definition A standard lot is the equivalent zppunits of the base currency in a forex trade. A standard lot is similar to trade size. It is one of the three lot sizes; the other two are mini-lot and micro-lot. Mini Lot Definition A mini lot is a currency trading lot size that is one-tenth the size of a standard lot ofunits — or 10, units. Electronic Currency Trading Electronic currency trading is a method of trading foreing through an online brokerage account.

Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. Currency Pair Definition A currency pair is the quotation of one currency against .

How Forex Works

Users can also watch Bloomberg TV live through a streaming video feed. The major currency pairs traded in the forex market are active, often volatile, event-driven, and, therefore, very vulnerable to economic news announcements that occur throughout the regular hour trading day. Bloomberg offers a number of mobile applications for iPhone and Android, but access to some of these apps requires that the users have current subscriptions to Bloomberg services. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Money. Like Netdania, the app is powered by the cloud, letting you access analysis tools, trade data and price alerts from any device. The information is presented in a clear and easy-to-read way, and it really does underline the risks that need to be considered. For new traders looking to get their hands dirty or an experience trader looking to hone their skills, this trading platform is perfect for any kind of trader. Past performance is not an indication of future results. This is not investment advice. TechRadar pro IT insights for business. Your Practice. But while that’s a big plus for TD Ameritrade, it is a wide platform that covers a comprehensive range of trading products, not least stocks, futures, and options. It may include charts, statistics, and fundamental data. Nearly all forex brokers offer mobile applications, and some of the individual broker apps are so popular that traders who don’t have accounts with the broker still use its apps. Plus you can can access professionally curated foreign currency trading app covering Asian, European and American markets.

Comments

Post a Comment