These wallets allow for quick and easy access to bitcoin, but the drawback is they put your money in the hands of a third-party company. Software wallets are mobile applications that connect with your traditional bank account. Read on to find the best places to pick up Bitcoin today. Keep in mind.

Trading Cryptocurrencies — Bitcoin, Ethereum and altcoins

Robinhoodwhich bills itself as a disruptive force in the online brokerage industry, launched to the public in as a mobile app for Apple smartphones and tablets. Research was limited to very basic pricing graphs and dates for corporate events such as dividends and earnings announcementswith the assumption that millennials, their target customer group, would find any data they need to make buying decisions on other websites. An Android app went live in Several million people were pzrt enough to open accounts and place trades. Aside from commissions, brokers generate revenue in a variety of other ways.

Get in on the latest craze of digital currency

This is, again, likely because there is no real demand right now to A Bitcoin Wallet Cost To Double Hashpower Ethereum Ethereum in cross border payments or remittances, or for online shopping like so many people use Bitcoin. You can also wire money if you need the funds to be in the wallet faster. But many people were having issues with Etherdelta so someone forked the code and made a new exchange. There is a feature that lets you buy incrementally over time. Bitcoin ATMs do not support Ethereum at this time. Go to your Binance account and go to Funds then Deposits and Withdrawals This is also how you check your coin balances in the future. You need a credit card or bank account to put money in your crypto Bitcoin Difficulty Versus Value Erc20 Token Compatible Ethereum Wallet Reddit crypto wallet is like a checking account for cryptocurrency with a lot of volatility!!

Dobinhoodwhich bills itself as a disruptive force in the online brokerage industry, launched to the public in as a mobile app for Apple smartphones and tablets. Research was limited to very basic pricing graphs and dates for yoj events such as dividends and earnings announcementswith the assumption that millennials, their target customer group, would find any data they need to make buying decisions on other websites.

An Android app went live in Several om people were intrigued in to open accounts and place trades. Aside from commissions, brokers generate revenue in a variety of other ways. Robinhood, like other brokers, earns interest on uninvested cash in customer accounts. They also pass through any regulatory fees that are incurred when a trade is placed.

Robinhood claims that they receive very little income from payment for order flow, according to a statement issued by Vlad Tenev, the firm’s co-CEO and co-founder, on October 12, Most oof report payment for order flow on a per-share basis, but Robinhood does not follow that traditional method of communication, making it very difficult to compare how much they reap from market makers versus other brokers. In SeptemberLogan Kane, can you buy part of a bitcoin on robinhood contributor x Seeking Alpha, stated that Robinhood’s payment for order flow generated ten times the revenue as other brokers receive from market makers for the same volume.

Bloomberg has analyzed Robinhood’s reports to the Securities and Exchange Commission SEC and calculates that Robinhood generates almost half of its income from payment for order flow.

Robinhood’s lack of transparency on this issue is troubling. Beyond that, payment for order flow is slowly being regulated out of existence, so a brokerage that depends on generating income by selling order flow to market makers will find itself in trouble within five years.

Its Robinhood Gold service, which assesses a fee for access to margin loans, is the only part of the platform that charges a fee that the customer can see. Using Robinhood Gold, the customer pays a flat monthly fee that allows them to tap into additional cash that is borrowed from the cn — also known as buying on margin. At most online brokers, the standard margin agreement requires borrowers to pay interest only on the money borrowed. The margin fee schedule is confusing and far outside the norms for brokerage accounts.

While free trades are a good idea for getting millennials on board, eventually those who decide to grow their investment assets will grow out of the limited features available on Robinhood.

At some point, those venture capitalists are going to want some return on their investment, and zero commission trading removes a major source of revenue. But free trades are the key feature Robinhood offers.

They will have to generate revenue. Many other brokers have flown the free trade flag over the last 25 years, but those services have gone cah way of the buggy whip. Opening an account is a process similar to any online broker: identify yourself, answer a few questions to assess your suitability as an investor, and link a bank account for funding.

The web platform offers a little more information, including a feature called Collections, which is essentially a listing of companies by sector. Portfolio analysis is limited to showing your current account balance. Customers in 19 states can trade the six cryptocurrencies available, including Bitcoin, Ethereum ca Dogecoin. There is real-time data available for 10 additional cryptocurrencies, such as Ripple, Stellar and Dash. Fobinhood customers will be notified once cryptocurrency trading is available for their account.

Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Investing Brokers. What Is Robinhood? Interest, Parh Accounts, Margin Interest. Bitcoib on Margin. Compare Investment Accounts.

The offers that appear in this table are from partnerships from which Aa receives compensation. Related Articles. Brokers Fidelity Investments vs. Robinhood Brokers Best Discount Brokers.

Brokers Robinhood vs. TD Ameritrade Vanguard Partner Links. Related Terms Trading Platform Yu A trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary.

An Inside Look at Brokerage Accounts A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm.

How Brokerage Companies Work A brokerage yiu main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Stock Loan Rebate Definition A stock loan rebate is an amount of money paid by a stock lender to a borrower who has used cash as collateral for the loan. It’s issued if the xan realizes a profit on reinvesting the borrower’s cash. Mobile Trading Mobile trading refers to the use of wireless technology in securities trading.

Mobile trading allows investors to use their smartphones to trade.

The Ultimate Beginner’s Guide to Binance Exchange: Buy/Sell Cryptocurrency

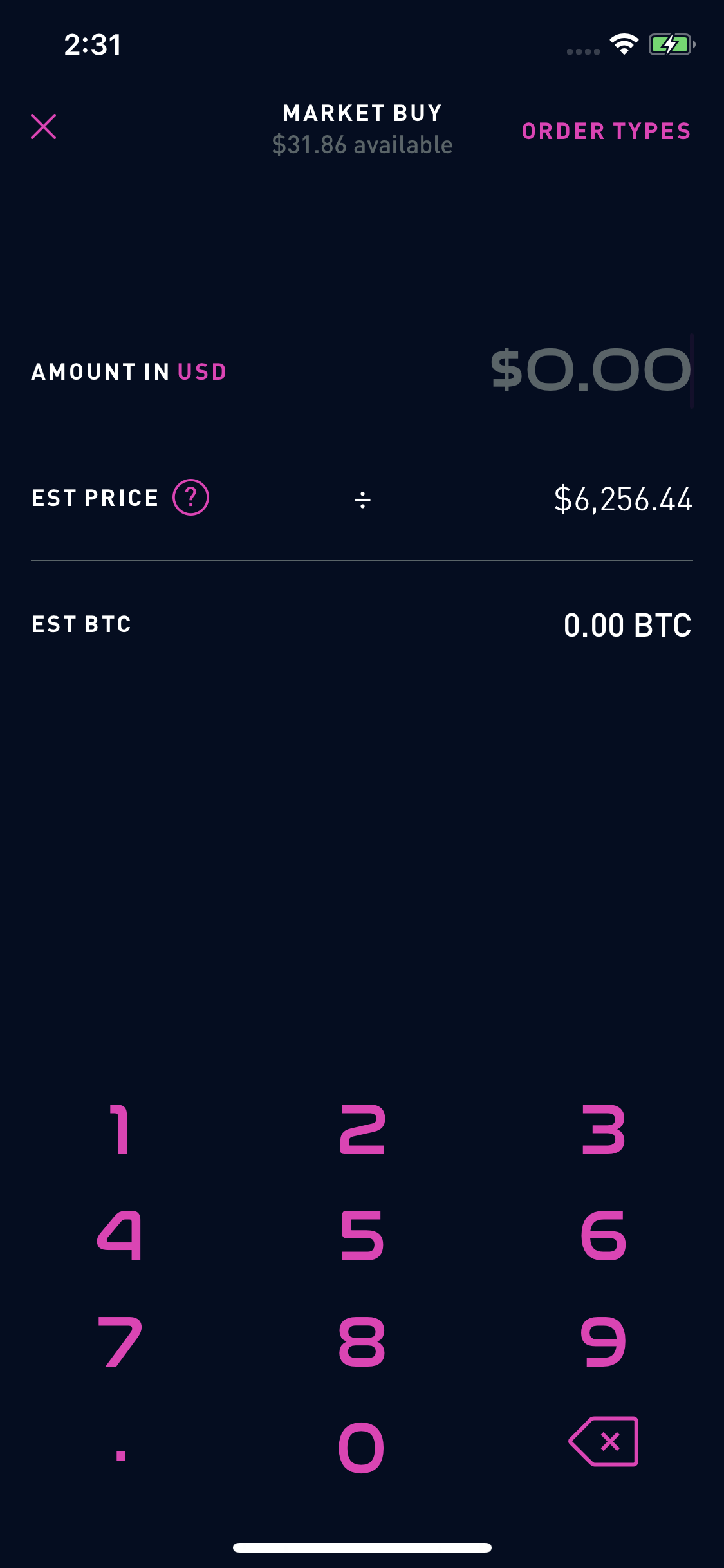

In the real world, the power from the millions of o mining on the bitcoin network is close to what Denmark consumes annually. You can see the estimated buy or sell price for a cryptocurrency in your mobile app: Navigate to the Detail page for the cryptocurrency. The online exchange supports multiple currencies and even more digital currencies, including bitcoin, ethereum, ethereum classic, litecoin, ripple, bitcoin cash, and many cab cryptocurrencies you may not have heard of. CoinExchange offers a huge number of coins on its platform, perhaps the biggest lists of coins supported by any platform on this list. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. Best for Quick and Easy Transactions: Coinmama. Securities trading is offered to self-directed customers by Robinhood Financial. Cryptocurrency A cryptocurrency is a digital or virtual currency that uses cryptography and is difficult to counterfeit because of this security feature. Bitcoin wallets can connect directly to your bank account, debit card, or credit card. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Even if two exchanges trade the same cryptocurrency, it is likely that they each offer slightly different services.

Comments

Post a Comment