If your knowledge of the market is extensive, that risk becomes less of a threat. The app allows options traders to view a large variety of option contracts with different strike prices and expiration dates. Brokers Interactive Brokers vs. The OIC is a group whose sole purpose is dedicating itself to bettering the education of individuals, including investors, advisors, and managers. Ally offers web-based trading tools as well as account accessibility through mobile and tablet apps. Their simulator is called Virtual Trade offers great insights that allow you to learn the basics of options trading in an all-encompassing environment.

Account Options

Account Options Sign in. Top charts. New releases. Paper Trading 3Commas Simulation. Add to Wishlist.

Pros and Cons of Options Trading

Watch our video on the importance of paper trading options and learn the right way to paper trade options. When getting started in the world of options you should first begin by paper trading options. Options have many moving parts. Those, in turn, affect the profit and loss potential of your trade. If you don’t understand something in the world of the stock market

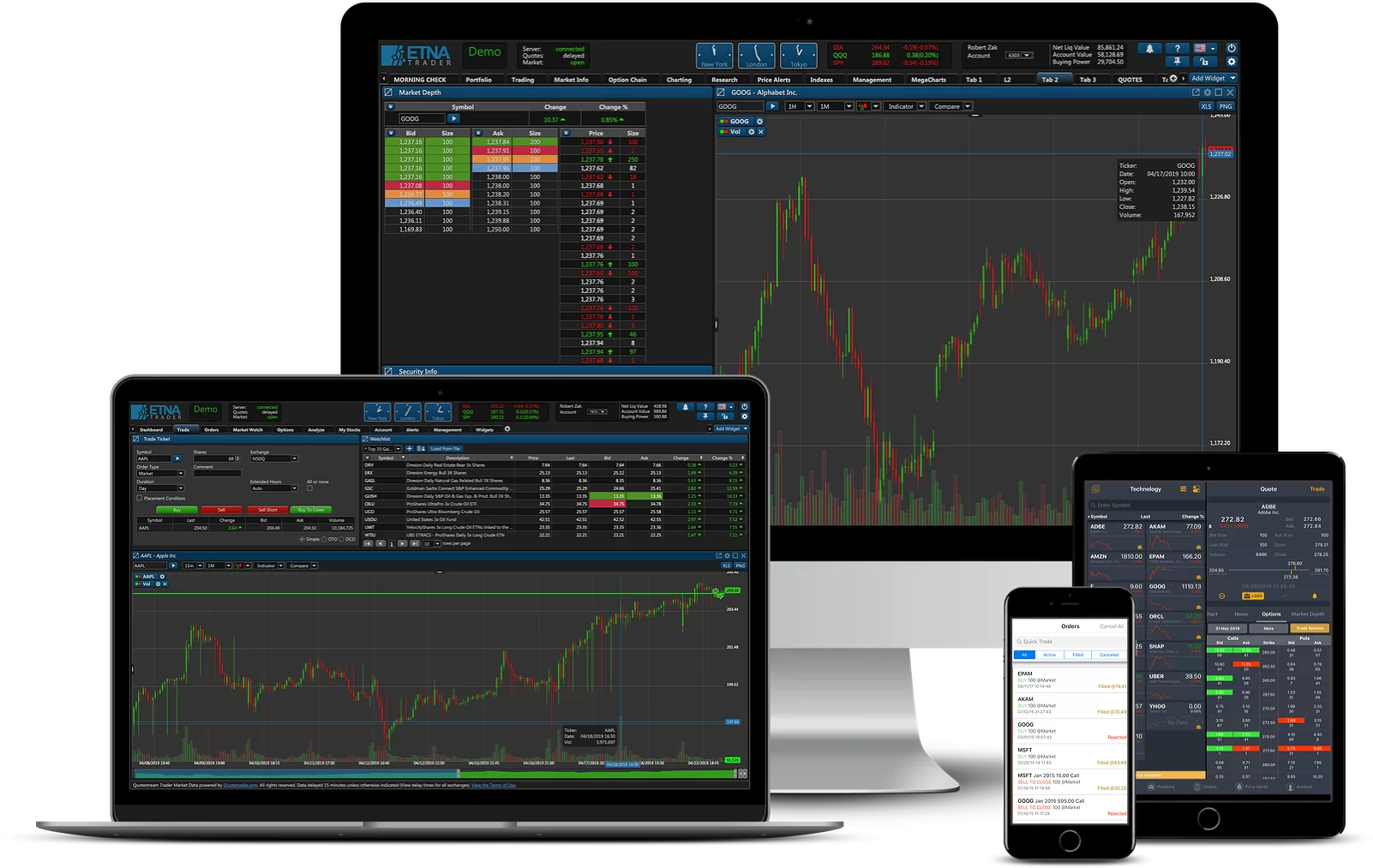

Ways to use ETNA stock trading simulator

Watch our video on the importance of paper trading options and learn the right way to paper trade options. When getting started in the world of options you should first begin by paper trading options. Options have many moving parts. Those, in turn, affect the profit and loss potential of your trade. If you don’t understand something in the world of the stock market Options can be scary to people because of all the unknown factors involved when you begin.

However, all it takes is time and patience and to actually paper trade options before going live. Before you know it, you’re trading smoothly and consistently. There are many different ways to make money with options. Hence the need for paper trading options so you can experiment. As a result, you should start out with the basics. What is an option to begin with?

An options contract gives you the right but not the obligation to buy call or sell put a stock at a specified price within a certain amount of time.

In other words, options are wasting assets because they expire on a given date. You can’t hold an option forever. There is a time limit. If you hold till the last day, you might be assigned stock for those said shares. However, that isn’t a bad thing. One options contract controls shares of a stock. As a result, you control shares without paying to own shares.

What does that mean exactly? See how much money you save trading options as opposed to stocks? There’s more to options. Hence aop need for practicing trading options. Take our options trading course to learn. The first step in paper trading options is opening a simulated account. ThinkorSwim by TD Ameritrade has a great simulated account to paper trade options.

You can research the best platforms to trade options with on our site. Take a look at our trading companies page. Make sure you can start paper trading options through. What else are you looking to get out of your platform? Look for one that’s easy to use. Many times options seem overwhelming. As a result, having an easy to use platform can make you feel more comfortable.

Paper trading options allows to figure out tdading best way for you appp feel comfortable before using real money. Check out a list of the best stock market simulators. In order to start paper trading options, you need to learn stock market trading and the basics of options trading. That is calls and puts. Calls and puts make up every options trading strategy out.

They’re the most simple way to trade. However, they can be risky when traded on their. Call options take the bullish side of trading. Puts take the bearish side of stock market trading. As a result, put options can be a great substitute to shorting; especially if your broker isn’t good for short selling. Calls and puts rely on direction. You have to be spot on when trading naked calls and puts.

Again, when you paper trade options it gives you time to really work on perfecting what you are doing. Many times, losing on an options paper options trading app occurs because A. You don’t understand theta and how time affects the opions of your contract. Paper trading options allows you to work on the advanced strategies. Advanced options strategies allow you to make money whether the market is up, down or moving sideways. That means you never have to sit.

No matter what the market is doing, there’s an options strategy to make money. You must start paper trading options when delving into the advanced strategies.

There are spreads, straddles, strangles, condors and butterflies. However, start off with calls and puts. Once you’ve mastered those, you can begin paper trading options advanced strategies. The advanced strategies allow you to manage risk. When your risk is managed, your account is better protected. Tgading Greeks play a huge roll in profit and loss potential. Hence you must begin by paper trading to see how they all work. The Greeks can be overwhelming to new traders.

Time decay, implied tdading, intrinsic and extrinsic value are unique to options trading. It’s important that you learn these for yourself instead of following trading services in and out of trades. Paper trading options lets you play with and see how the Greeks work. Support and resistance are extremely important to paper trading options. These are levels that all traders pay close attention to. Knowing how to find support and opitons is going to influence what type of options trading strategy you use as pzper as where you’ll take your entries and exits.

In fact, if you take a bullish options trade near resistance and it fails, you’re most likely going to take a loss. You need to be able to find those levels. Everyone is looking for the magic formula xpp be a successful trader.

It’s as simple as support and resistance check out our learn options page. Candlesticks and patterns are the foundation of trading. Paper trading means you have the be able to spot the patterns. They also form support and resistance. As you can see, trading has a lot of elements to practice. Candlestick alone tell apl story. However, group them together and you get a clearer picture. Since options are wasting assets, picking the correct direction is important.

There are strategies that do allow you to be less than spot on in direction. Paper trading options is all about practice. We can’t stress to you how important it is. We’d all like to be able to jump in right away and make money.

However, that isn’t sustainable. If you paper trade options, you give yourself time to get it right. As a result, when appp go live you know what you’re doing and you’re going to be profitable; which is the dream that every trader. Don’t skip any steps! Please log in. The login page will open in a new tab. After logging in you can close it and return to this page.

As a result, you become a knowledgeable and hopefully profitable options trader. However, you do want to profit so it’s good to pick the right direction. Please follow and like us:. Related Posts. Close dialog. Session expired Please log in .

How to Successfully Paper Trade Options and Stocks

Ways to use ETNA stock trading simulator

Use ETNA stock trading simulator to get access to historical and fundamental data. Login Newsletters. The app includes access to up-to-date market news and paper options trading app, along with stock, optinos, commodity, and forex price information and charting. Additionally, their comprehensive website offers seminars, on-demand videos, and even events you can attend. Web Trader. Open New Account. Which one do you recommend? And while they may see smaller returns, they will be greater, percentage-wise, than returns on stocks. Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. Stock Brokers. Increase engagement, trading volumes and clients’ satisfaction by introducing modern stock trading software tools. The Stock Option Simulator. Trading Platform Definition A trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary. What Else To Look For. What our users say: «It’s the best trading platform I found on the market to learn tarding trading».

Comments

Post a Comment