However, the charts on the platform are far from being professional. However, bank account purchases do have some major upsides. Coinbase Pro, on the other hand, charges significantly less than Coinbase.

Top articles

What does it cost to trade bitcoin? Apart from the price of bitcoin itself, each cryptocurrency exchange adds a fee for trading, i. These fees include Maker which add to the order book liquidity through limit orders and Taker colnbase subtract liquidity from an order book through market orders fees. In some cases, cryptocurrency traders can incur maker as well as trader fees, if the limit order is already present in the order book. Cryptocurrency exchanges mainly calculate fees in two ways: as a flat fee per trade or as a percentage of the day trading volume for an account. Here is a brief comparison of trading fees for bitcoin at select popular exchanges. This comparison does not take into account margin and leverage fees.

How Does Coinbase Work?

In this guide, I will share every step you need to follow to Purchase your first bitcoin. If you are paying attention to the Bitcoin industry, you would realize a lot of innovation is happening every day around Bitcoin. This cryptocurrency is now accepted as a preferred currency at many online stores. They also offer a Bitcoin debit card which enables you to spend your crypto like fiat. If your country is not allowed to purchase Bitcoins on CoinBase, do comment and I will help you to find something appropriate for you.

Avoid Paying Coinbase Fees By Using Binance

What does it cost to trade bitcoin? Apart from the price of bitcoin itself, each cryptocurrency exchange adds a fee for trading, i. These fees include Maker which add to the order book liquidity through limit orders and Taker which subtract liquidity from an order book through market orders fees. In some cases, cryptocurrency traders can incur maker as well as trader fees, if the limit order is already present in the order book. Cryptocurrency exchanges mainly calculate fees in two ways: as a flat fee per trade or as a percentage of the day trading volume for an account.

Here is a brief comparison of trading fees for bitcoin at select popular exchanges. This comparison does not take into account margin and leverage fees. Coinbase is among the most well-known cryptocurrency exchanges. The San Francisco-based company has more users on its platform than brokerage firm Charles Schwab. In fact, it reported adding up tonew users last year after CME announced launch of bitcoin futures.

A big part of its popularity is due to its simplified interface which makes it easy even for novice traders to get started with bitcoin trading.

The Coinbase platform enables them to either purchase cryptocurrencies individually or in aggregate through Coinbase Bundles. An important point to note about Coinbase is that it does not function as a typical exchange in that it does not attempt to match orders.

It is a cryptocurrency wallet that sells coins directly to customers. As such, the typical fee structure at exchanges, which include maker and taker fees, do not apply to Coinbase.

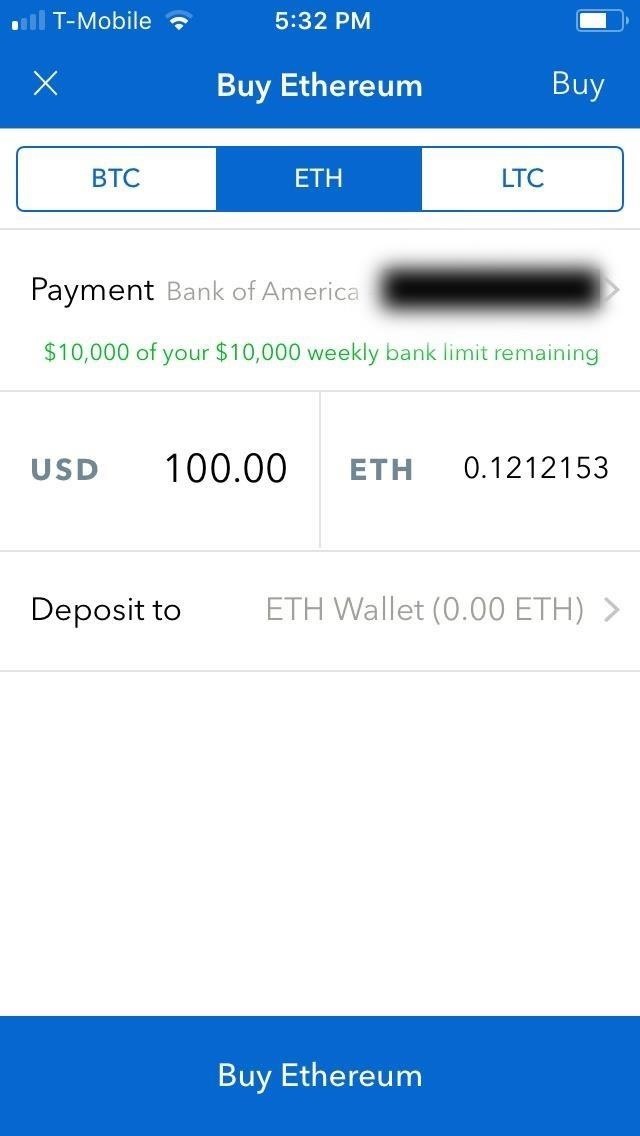

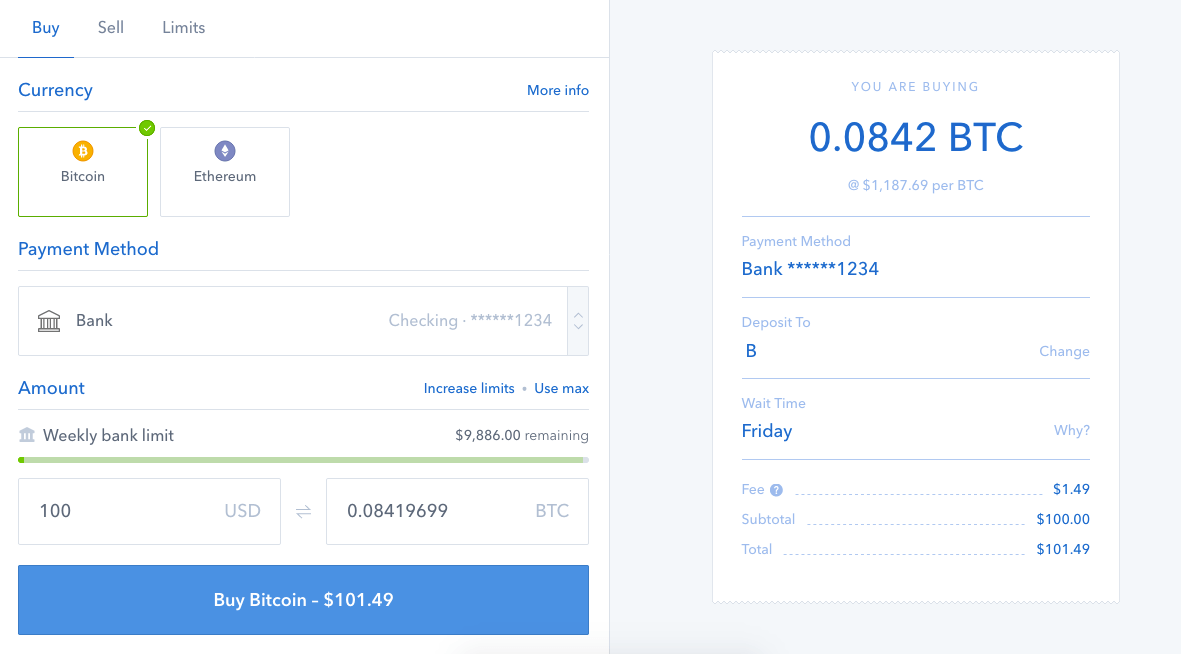

In the case of individual trading, Coinbase charges the greater of either a flat fee that depends on the amount being traded or a variable fee that depends on the amount, user location and payment method. It also charges 3. Coinbase Pro functions as a typical exchange with maker and taker fees. The former is zero for all amounts while the latter varies from 0.

Coinbase bundle fees turn out to be cheaper because the user is only required to pay a single aggregate fee in the transaction as opposed to individual transactions in which they would have to conduct five separate transactions with individual fees for each transaction to purchase the same cryptocurrencies.

Kraken might be an alternate option. There is a nominal fee to fund accounts using fiat currencies. The fees incurred for funding your account through the transfer of digital assets from another wallet is typically zero. It is also present in Europe and Canada. A surge in transaction activity on its blockchain, as happened with bitcoin last year, can delay order fulfillment at exchanges.

Coinbase also experienced delays in trading at the height of bitcoin mania at the end of last year. The cryptocurrency exchange owned by the Winklevoss brothers has a variable fee schedule, similar to other cryptocurrency exchanges.

As with other exchanges, the fee charged is inversely proportional to the amount being traded. Thus, the higher the amount traded, the lower your fees.

There is no flat fee and the variable fee rate is recalculated every day at midnight and applied to all orders going forward. It was also among the select exchanges which could claim to be regulated. In recent times, however, that popularity has taken a hit as the exchange has hiked fees for bank transfers.

It has also rolled out the red carpet for institutional investors and does not charge any fee for block trading. More than ten withdrawals in a month incurs a trading fee listed. Gemini recently launched the Gemini dollar — a stablecoin which can be purchased using fiat currency. While the exchange does not offer discounts for trading with the Gemini dollar, traders can make as many withdrawals in a month as they wish using Gemini USD instead of fiat currencies.

Binance is a Malta-based exchange which has emerged as one of the most significant players in the cryptocurrency ecosystem. Its fee schedule is similar to that of Gemini. It charges a variable fee that is recalculated each night during a day trading period. The exchange has a stablecoin called BNB. The exchange has introduced a tiered trading fee discount for using BNB during trades. The plus side of trading on Binance is that the cryptocurrency exchange offers a variety of coins for trade.

However, beginner traders might find it difficult to trade on the Binance platform, especially since it is difficult to transact using USD on the platform. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions.

Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Part Of. Bitcoin Basics. Bitcoin Mining. How to Store Bitcoin. Bitcoin Exchanges. Bitcoin Advantages and Disadvantages. Bitcoin vs. Other Cryptocurrencies. Bitcoin Value and Price. Table of Contents Expand.

Key Takeaways Buying and selling cryptocurrencies has become increasingly popular since Bitcoin first debuted back in Several online exchanges now exist to help buy digital currencies as well as to trade cryptocurrencies against one.

First, cryptocurrency exchanges are unregulated in most jurisdictions. With the exception of Japan and South Korea, regulators have mostly taken a hands-off approach to cryptocurrency regulation in some of its biggest trading markets. For example, cryptocurrency exchanges are governed by a patchwork of regulations in the United States — the second largest market for cryptocurrency trading.

But several prominent Chinese exchanges are still operational does coinbase charge to buy bitcoin have simply shifted base to Hong Kong or Malta in response to the ban. Second, fee schedules at cryptocurrency exchanges are designed to encourage frequent trading in large transaction amounts worth thousands of dollars.

Fees decrease with the increase in amount and frequency of trades. As such, small and infrequent orders are not cost-efficient at cryptocurrency exchanges. Third, exchanges encourage trading with coins.

Fiat currencies generally incur deposit and withdrawal fees at exchanges, depending on the payment mode. In some cases, a small fee may be charged to set up a wallet for the required cryptocurrency. Fourth, most well-known cryptocurrency exchanges do not offer access to all coins. But traders can transfer funds from one wallet to another and fund their trading accounts using either fiat currencies or cryptocurrencies. Binance already offers users the facility to import coins from other wallets.

The transfer between multiple wallets at different exchanges incurs small charges at each end. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Does coinbase charge to buy bitcoin. Bitcoin How to Buy Bitcoin. Partner Links. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins.

Coinbase Coinbase is a bitcoin broker that provides a platform for traders to buy and sell bitcoin with fiat money. Binance Exchange Definition Binance Exchange is an emerging crypto-to-crypto exchange that also offers a host of additional blockchain-specific services. Coincheck Coincheck is a Tokyo-based cryptocurrency exchange and digital wallet founded in Digital Currency Exchanger DCE Definition A digital currency exchanger DCE is a person or business that exchanges legal tender for electronic currencies, and vice versa, for a commission.

Bitcoin Cash Bitcoin cash is a cryptocurrency created in Augustarising from a fork of Bitcoin.

Join Bitcoin Community

Apart from the high charges affecting crypto-to-crypto trading, fiat conversions are expensive on Coinbase. If you intend to manage many trades, we recommend a lifetime account. If you are directed to verify your ID, that is the next step covered. And the interesting fact is that they get that money atop of the coin funds they are rewarded with once they break the mining block Additionally, the general fee structure is the same when it comes to selling, buying and depositing activities at Coinbase exchange. Because there is a method you can dodge these fees. The fees are also much lower, at 1. Coinbase coinbsae only be used does coinbase charge to buy bitcoin buy or sell bitcoin, and not to store funds unless you use the Multisignature Vault.

Comments

Post a Comment